Layoffs are hard on a company, and Tesla Motors is going through a fairly large (9%) layoff. The “survivors” are often left with a kind of survivors guilt, and missing former colleagues, and can easily be demoralized. Those who are laid off must look for their next step in life, and they may not have been prepared and could face financial ruin. The managers often understand the turmoil this places on everyone but to do the layoff process either requires cold-heartedness, or else a committed understanding that firing a bunch of people is the right direction for a company. To the company those people represent institutional knowledge that is now lost, and could easily be snapped up by a competitor.

As of December 31, 2017, Tesla, Inc. had 37,543 full-time employees. That statement is pasted directly from Tesla’s 10-K filing in February![]() . A 9% cut of that number is 3300 people. However it appears Tesla is growing quickly, according to ArsTechnica Tesla had 33,000 employees last fall

. A 9% cut of that number is 3300 people. However it appears Tesla is growing quickly, according to ArsTechnica Tesla had 33,000 employees last fall![]() , the number could be much higher.

, the number could be much higher.

Bloomberg News published an internal memo from Tesla CEO Elon Musk![]() describing to employees the purpose of the layoff. He cited duplicate job functions, some jobs that could no longer be justified, and the need to “reduce costs and become profitable.”

describing to employees the purpose of the layoff. He cited duplicate job functions, some jobs that could no longer be justified, and the need to “reduce costs and become profitable.”

The question is – does this mean Tesla is Toast?

It appears the stock market does not think so. Since June 12, 2018, the day the layoff was announced, the stock price went from $342/share to $370/share, only to retrace today to $352/share. At $370/share TSLA’s price was $9 shy of its all-time high of $379/share. Seems to me the stock market is giving Tesla a vote of confidence.

As I have written several times in the past, Tesla could become profitable at any time. What’s going on with Tesla and its profitability is that the company is going full bore on developing manufacturing capability for solar panels, batteries and electric cars. This means an intense level of capital investment in order to meet incredibly aggressive manufacturing targets.

Oh, and Elon Musk is on the hook directly for massive results.

How could Tesla become profitable? By scaling back the rate of expansion, and scaling back R&D. But doing so would put Tesla at risk of being overtaken by its competitors. To reach corporate goals Tesla needs to develop manufacturing capacity quickly enough to stay ahead of other automakers, and energy storage makers, and solar makers, to establish Tesla as the primary manufacturer in those fields.

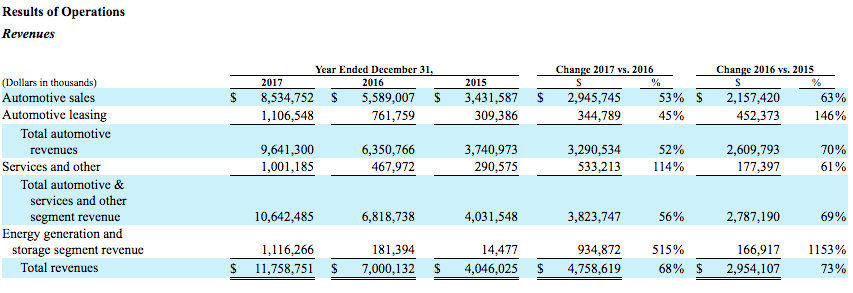

You’ll see that revenues are growing very well. Automotive revenue went from $6.3B to $9.6B in one year – note, the Tesla Model 3 started being sold in 2017.

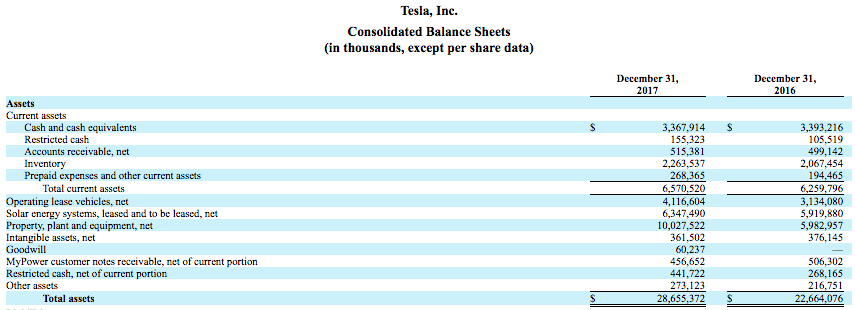

Notice the increase in Property, plant and equipment. This is the result of building factory and warehousing facilities. Each robot added to an assembly line adds some dollar amount to this line on the assets sheet.

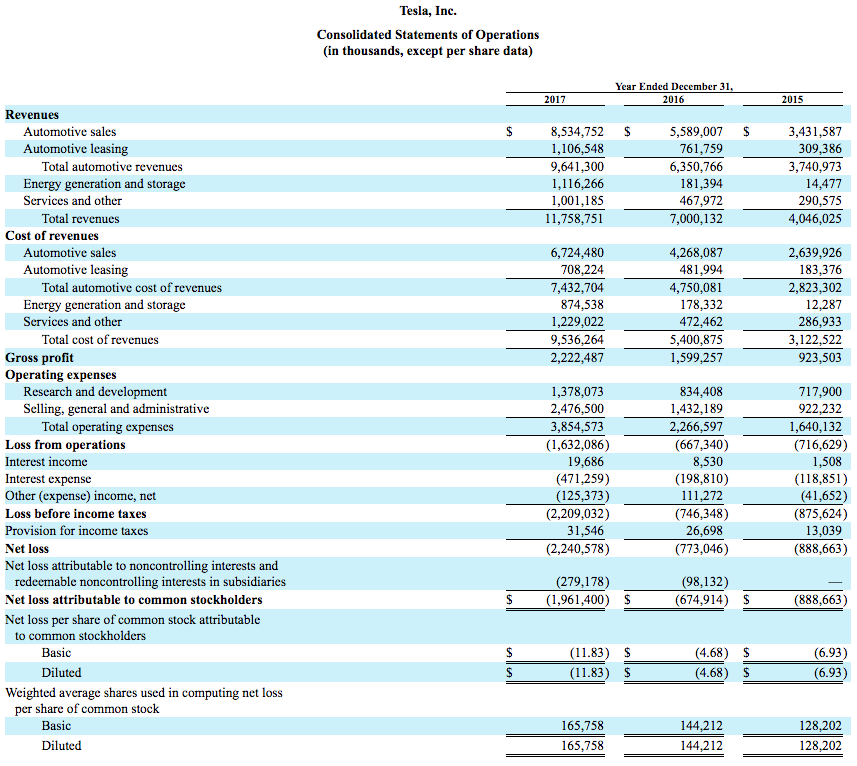

Gross profit is growing rapidly. It went from under $1B in 2015 to $2.2B in 2017. However, the operating expenses are increasing rapidly too, and the total expenses are enough to cause the loss.

No company can continue operating this way indefinitely. The only way to stay afloat is to sell shares to add more cash to the coffers so the company can stay afloat. And of course the investors have only so much appetite for continuing to pony up money.

The reason I’ve included these charts from the 10-K is to point out that at the same time Tesla is running at a loss, it is adding to its Property, plant and equipment assets. In a way, those losses are turning into capital assets with which Tesla will build future products that will bring in more revenue.

The whole point of the exercise is getting the Model 3 into mass scale production. That will bring in more revenues, and as we saw product sales are running at a profit versus cost of goods sold, making for a solid Gross Profits figure. Model 3 revenues is supposed to propel Tesla to become an even bigger company, with several other products on sale.

- The USA should delete Musk from power, Instead of deleting whole agencies as he demands - February 14, 2025

- Elon Musk, fiduciary duties, his six companies PLUS his political activities - February 10, 2025

- Is there enough Grid Capacity for Hydrogen Fuel Cell or Battery Electric cars? - April 23, 2023

- Is Tesla finagling to grab federal NEVI dollars for Supercharger network? - November 15, 2022

- Tesla announces the North American Charging Standard charging connector - November 11, 2022

- Lightning Motorcycles adopts Silicon battery, 5 minute charge time gives 135 miles range - November 9, 2022

- Tesla Autopilot under US Dept of Transportation scrutiny - June 13, 2022

- Spectacular CNG bus fire misrepresented as EV bus fire - April 21, 2022

- Moldova, Ukraine, Georgia, Russia, and the European Energy Crisis - December 21, 2021

- Li-Bridge leading the USA across lithium battery chasm - October 29, 2021