Earlier today Tesla Motors released its Q4 2015 financial results. The company claims it has strong sales growth, and now that the Tesla Model X is in production financial results throughout 2016 will improve greatly. Since this continued growth of Tesla as a business depends on growing their car sales, especially with the Model X and Model 3 starting to be sold, it’s useful to examine what was said in the conference call. The high points are that Tesla Motors is successfully selling cars without doing any advertising, the Model S is the top selling car in its segment in many places, that sales are strong even in countries with no tax breaks, that customers are looking for the best car, and that assuming the Model 3 is as excellent as the Model S, Tesla Motors will have no problem competing against the Chevy Bolt even though the Bolt will have a 1 year head start.

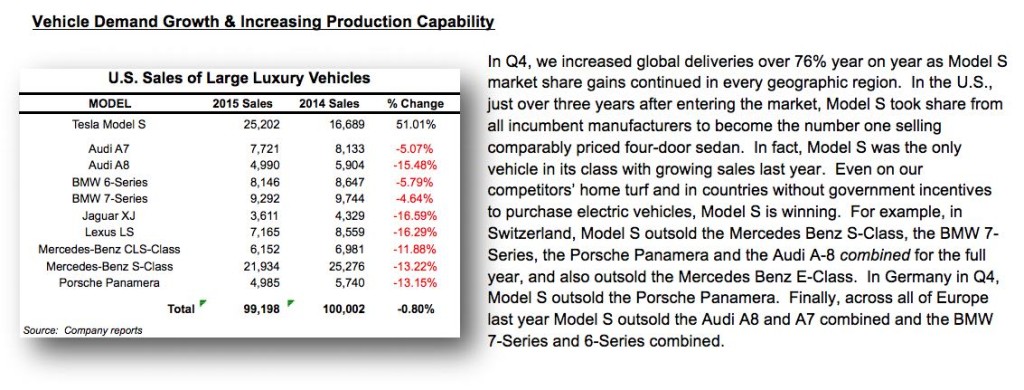

Let’s start with the chart above. U.S. sales of 25,000 cars, outselling basically every car in its class, some by a huge margin. Also, for every car named their sales rate is shrinking while the Model S sales rate is growing strongly. What’s not clear from this chart is whether Tesla Motors named every car in its class, or whether they cherry-picked cars to make this claim – that the Model S is the only luxury car whose sales is growing. And, this would suggest the strength of Model S sales is at the detriment of other car-makers.

Tesla Motors does not run advertising nor do other things other automakers do to drum up business. Tesla’s management has repeatedly said the company is not “demand constrained” – they have plenty of customers demanding their product, their constraint is the company’s manufacturing capacity. Therefore there’s no need to do all those marketing tricks other automakers have to do, the world is beating a path to their door begging to be allowed to buy their cars.

This is perhaps an unprecedented position, as Elon Musk suggested. That an upstart company, that’s just now starting manufacturing of its second self-designed car (the Tesla Roadster was a conversion based on a Lotus car), would have such a rabidly loyal following.

Tesla Model S sales growth is even strong in countries where there’s no electric car tax credits.

In fact, Model S was the only vehicle in its class with growing sales last year. Even on our competitors’ home turf and in countries without government incentives to purchase electric vehicles, Model S is winning. For example, in Switzerland, Model S outsold the Mercedes Benz S-Class, the BMW 7- Series, the Porsche Panamera and the Audi A-8 combined for the full year, and also outsold the Mercedes Benz E-Class. In Germany in Q4, Model S outsold the Porsche Panamera. Finally, across all of Europe last year Model S outsold the Audi A8 and A7 combined and the BMW 7-Series and 6-Series combined.

New Model S orders grew over 35% year on year in Q4, with growth in all regions. Even with this growth, we believe that we remain substantially underpenetrated in all of our markets because of our limited retail presence.

One of the concerns with current conditions is that the current low gasoline prices will impact electric car sales. As I’ve demonstrated elsewhere, electricity is a cheaper fuel than gasoline, and it’s possible to save lots of money on fuel costs just by driving an electric car as much as possible. However, I’ve just been taking a closer look at those numbers and determined there’s a cross-over point that if gasoline falls below $1 per gallon electricity becomes the more expensive fuel. Last time I looked, some places in the U.S. have gasoline prices below $1.30 per gallon, so we’re moving quickly to a condition where electric cars no longer have this economic advantage.

What Tesla Motors says is that they’re not seeing low gasoline prices impacting their electric car sales.

Additionally, we continue to see no perceptible impact to our order growth from the change in the price of gasoline as our order rates have continued to increase even as the price of gasoline has fallen. In fact, our customers tell us they value a Tesla vehicle more for its superior performance, technology, safety, lower environmental impact and style than for its ability to save money on fuel. We are also seeing this with the strong demand for pre-owned Tesla vehicles, which are trading at prices higher than our expected residual values.

Talking about the Model X, Elon Musk did express one regret. Namely that they put too many cutting edge highly advanced features in the car that it became tricky/difficult/expensive/hard to get the car to work right. He didn’t say it, but I have to ask this — does anybody really need a car whose doors automatically open when they approach the car? Just how lazy are people anyway? Sheesh. In any case, he wished they’d scaled back their plans a bit and perhaps rolled out some of the features in a later update. That said they expect the Tesla Model X to simply be the best car ever, and that he’s not sure if any car company will ever make a car like this again.

For the Tesla Model 3, a big concern we all have is what effect there will be due to the Chevy Bolt having a 1+ year head start. The Bolt is due to go on sale later this year, the Model S in late 2017 (if Tesla Motors actually meets their projections). Hence, does a 1 year head start mean Tesla will lose out to General Motors?

Elon Musk didn’t directly answer this, but said — paraphrasing — that since the Model 3 will be as excellent in its segment as the Model S is in its segment. Therefore, Tesla Motors will be as successful with the Model 3 as it is with the Model S. Look at the numbers above and you see the Model S is outselling every car in its segment. The Model 3 is positioned against the BMW 3-class cars. Ergo, Elon’s not worried.

- The USA should delete Musk from power, Instead of deleting whole agencies as he demands - February 14, 2025

- Elon Musk, fiduciary duties, his six companies PLUS his political activities - February 10, 2025

- Is there enough Grid Capacity for Hydrogen Fuel Cell or Battery Electric cars? - April 23, 2023

- Is Tesla finagling to grab federal NEVI dollars for Supercharger network? - November 15, 2022

- Tesla announces the North American Charging Standard charging connector - November 11, 2022

- Lightning Motorcycles adopts Silicon battery, 5 minute charge time gives 135 miles range - November 9, 2022

- Tesla Autopilot under US Dept of Transportation scrutiny - June 13, 2022

- Spectacular CNG bus fire misrepresented as EV bus fire - April 21, 2022

- Moldova, Ukraine, Georgia, Russia, and the European Energy Crisis - December 21, 2021

- Li-Bridge leading the USA across lithium battery chasm - October 29, 2021

I have long been involved in the EV community, and I think I’m about as well-informed about EVs as a person can be. I have a RAV4EV with a lease coming up at the end of the year. And, despite my research, at present I do not know whether I will buy out the RAV lease, or get a Bolt, or get a Tesla 3. From here, there is no obvious way to decide. I look forward to being able to get seat time in the Bolt and the T3 and learning their real purchase/lease costs, so that I can make a good decision.