The current stock market turmoil – a major stock price collapse in China and other countries – may be (partly) caused by the glut of oil causing low crude oil prices. What’s happening is a market correction a.k.a. “global selloff” of stocks a.k.a. slumping stock prices in stock markets around the world, that’s supposedly due to “weak economic data” in China. Some are pushing fear this stock slump is a precursor to a global complete collapse of the financial system, but what I’m seeing nothing anywhere near so drastic but it’s still disturbing the effects of this collapse. However, an interestingly large side story to the slumping markets is the drastically falling price for crude oil and the stamina of America’s fracking-induced crude oil boom.

Last winter OPEC decided to keep pumping crude oil at a steady pace in the face of the first stage of a glut in the global oil market. Prices were falling anyway, and OPEC’s move was meant to force global oil prices even further down in an attempt to drive the fracking-based US oil boom to flail and sputter out. Supposedly the cost to produce oil via fracking in the U.S. is very high and OPEC hoped to force the global oil price below the threshold where America’s frackers cannot afford to operate.

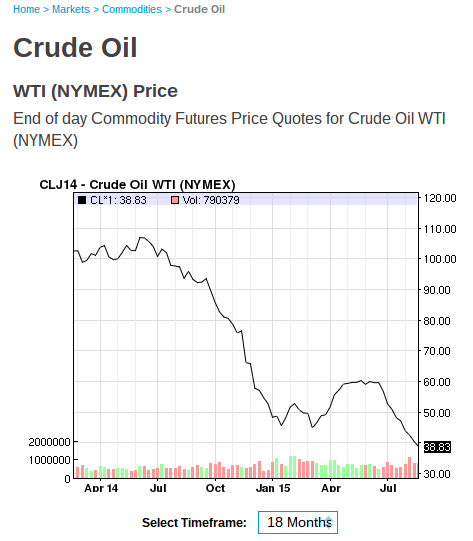

The chart at the top shows the WTI crude oil price index for the last three years as of August 26, 2015, while the second chart shows the price for the last 18 months. We see a price decline began in July 2014, a rebound between April and July 2015, and now a steeply falling price – where the highest price was $105/barrel and is now at $38/barrel.

Cheap oil is good, right? It means lower gasoline prices, something people have complained about for most of the last 10-15 years. Right?

Those of us who want our world to abandon fossil fuels of course worry when oil prices fall, because it removes one of the incentives to stop using the stuff.

But it turns out there’s another downside to falling oil prices. Some oil producing countries grew dependent on high oil prices and now the lower prices are giving those countries an economic challenge (according to the NY Times![]() ).

).

Nigeria and Venezuela are fearing unrest because both rely almost exclusively on income from producing oil. With lower income will come economic troubles which are likely to cause unrest.

In Saudi Arabia, the royal family has spent its oil money lavishly which propped up the economy, but with falling oil revenues they’re now having to spend $10 billion a month of their foreign exchange holdings, and are having to borrow money, to keep that particular game afloat.

The economic problems in China are making the situation worse – because lower economic activity means lower oil consumption. The NY Times article suggests that where the market had begun to think oil prices would stabilize, China’s troubles mean oil prices will stay low for longer than expected and cause more economic damage to oil exporting countries.

What’s the cost to these oil exporting countries? The NY Times quotes René G. Ortiz, former secretary general of the Organization of Petroleum Exporting Countries and former energy minister of Ecuador as saying that collectively they’ve lost $1 trillion in revenue over the last year.

That’s a lotta oil revenue moolah.

The major global driver for high oil prices has been China – because that country doesn’t have much domestic oil supply, and their factories have become the go-to-place for manufacturing anything for nearly any country. A slowdown in China’s factory output means a slowdown in oil consumption making for falling revenues for oil producing regions.

Supposedly the deal with Iran will also play a role in driving down global oil prices. Where before Iran had been under an embargo that mostly kept their crude oil production off the global market, the new deal will allow Iran to start selling into the global market. That contribution to the “glut” condition should further lower oil prices.

On the other hand, according to a local business report from the Alberta Tar Sands region, the producers there are continuing to produce crude oil even though their cost is above current oil prices![]() . They must keep producing to keep covenants with their bond-holders, for example. Which makes one wonder how long they can keep it going.

. They must keep producing to keep covenants with their bond-holders, for example. Which makes one wonder how long they can keep it going.

A Bloomberg report![]() predating the China market crash talks about five countries, Algeria, Iraq, Libya, Nigeria and Venezuela, which are most vulnerable to economic problems due to low oil prices. Venezuela is having debt problems, Nigeria’s cash on hand buffer is shrinking rapidly, Algeria and Libya are both running at a deep deficit, etc.

predating the China market crash talks about five countries, Algeria, Iraq, Libya, Nigeria and Venezuela, which are most vulnerable to economic problems due to low oil prices. Venezuela is having debt problems, Nigeria’s cash on hand buffer is shrinking rapidly, Algeria and Libya are both running at a deep deficit, etc.

According to the Denver Business Journal![]() , falling oil and natural gas prices it’s expected production in Colorado will decline, and local communities will see lower tax revenues and subsequent budget crunches. “What happens when the prices are cut in half? That revenue stream is essentially cut in half,” said Brian Lewandowski, lead author of the report and associate director of the CU-Leeds Business Research Division.

, falling oil and natural gas prices it’s expected production in Colorado will decline, and local communities will see lower tax revenues and subsequent budget crunches. “What happens when the prices are cut in half? That revenue stream is essentially cut in half,” said Brian Lewandowski, lead author of the report and associate director of the CU-Leeds Business Research Division.

I’m unhappy with the current situation for two reasons.

- Low oil prices mean a smaller incentive to switch to clean energy technologies, especially electric vehicles.

- Long term the price for crude oil, natural gas, etc, is UP because of an inevitable supply crunch. But the current situation makes that story easy to dismiss, we are in the middle of an oil supply glut.

It means decisions made now will be influenced by a false set of conditions. If the low oil prices cause low gasoline prices, the switch to electric vehicles will be delayed because of artificially low oil prices. Any delay in adopting clean energy technologies – not just electric vehicles but renewable energy technology – means the climate change situation won’t improve.

Image source: NASDAQ website

- The USA should delete Musk from power, Instead of deleting whole agencies as he demands - February 14, 2025

- Elon Musk, fiduciary duties, his six companies PLUS his political activities - February 10, 2025

- Is there enough Grid Capacity for Hydrogen Fuel Cell or Battery Electric cars? - April 23, 2023

- Is Tesla finagling to grab federal NEVI dollars for Supercharger network? - November 15, 2022

- Tesla announces the North American Charging Standard charging connector - November 11, 2022

- Lightning Motorcycles adopts Silicon battery, 5 minute charge time gives 135 miles range - November 9, 2022

- Tesla Autopilot under US Dept of Transportation scrutiny - June 13, 2022

- Spectacular CNG bus fire misrepresented as EV bus fire - April 21, 2022

- Moldova, Ukraine, Georgia, Russia, and the European Energy Crisis - December 21, 2021

- Li-Bridge leading the USA across lithium battery chasm - October 29, 2021